Car insurance has skyrocketed over the last few years, with new or younger drivers getting quoted upwards of 4 to 5 thousand on small otherwise affordable cars. We’re here today to teach you how to reduce your car insurance quotes as a new driver, and not give in to these incredibly high prices. There are a few relatively simple tricks you can try to lower your car insurance.

If you don’t have time to stick around and read the full article, we will outline all our tips below in one easy to digest package.

Note: Before we start we have to make clear that you should never lie to your car insurance provider, as it could result in a voided policy.

How to reduce car insurance in 2024 – at a glance

- Compare comparison sites – Don’t just use one, use as many as you can!

- Find a car that is cheap to insure – A good, safe car with a smaller engine displacement is best, alternately, you can go for a car that is uncommon in your age bracket.

- Play around with your job title – Insurers can’t give you every job title in the world, so choose a few that basically describe what you do and see which is the cheapest among them.

- Set your Insurance to start between 2 and 3 weeks ahead of time – Often times, insurance quotes will be more expensive the sooner you want your policy to start.

- Add an older named driver with a clean record – The best candidates for named drivers are parents or older siblings.

Compare comparison sites

I know it sounds silly, and it’ll be more than a tiny inconvenience to fill out your details 5 or 6 times over, but it’ll be worth it if you end up saving a lot on your car insurance. If you need some help finding the best car insurance comparison sites, you can find the ones we recommend below:

Find a car that is cheap to insure

The odds are that these cars are going to be your small engine hatchbacks that are the new driver staple, but ones that all the boy racers and bad drivers avoid. You could also try breaking the mould and finding an obscure car that almost nobody in your age bracket has. It’s about the same for me, a driver of 2 years, to ensure a 5.2 Audi S6 Avant, than it is a 1.4 Golf. So work that one out.

We spent the last few days looking for the best cars to insure for new drivers, some examples of cars that are actually cheaper for to insure are as follows:

- Vw Polo (around 2005 – 2014)

- Seat Ibiza (around 2011 – 2015

- Dacia Sandero

- VW UP

- Fiat 500

Your results may vary, in fact, I can pretty much guarantee that they will.

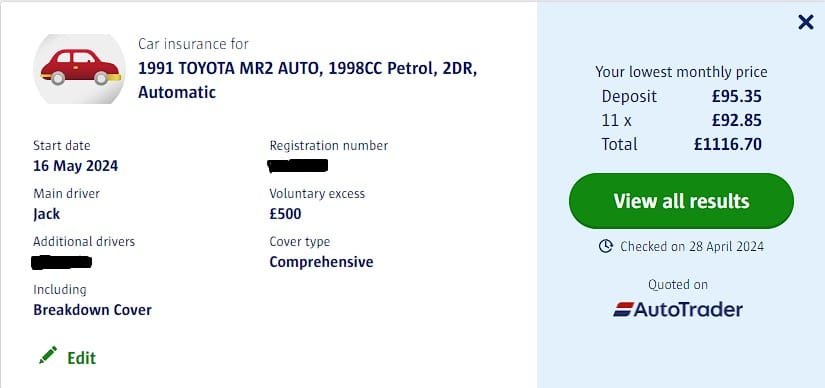

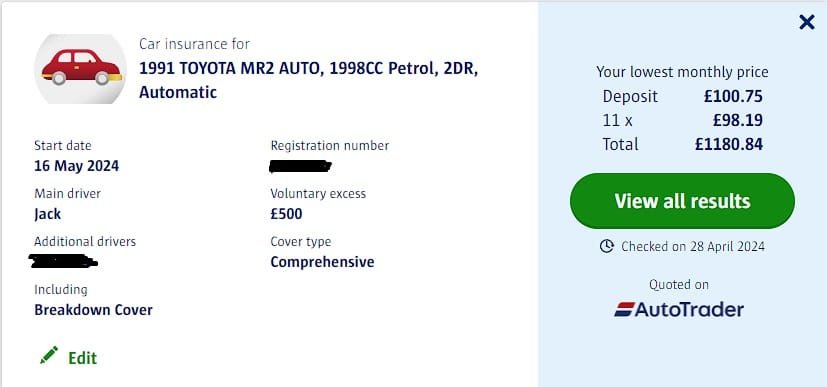

Play around with your job title

Insurers consider professions almost as heavily as they consider your address, so it’s important you have a look around and assess the options. I’m a writer by trade, so in my insurance, I tell them I am a marketing writer because that was the cheapest quote. I tried other titles like content manager, copywriter, and different industries like sales, which all resulted in higher premiums.

The differences aren’t inconsequential either.

Just by changing my job title to essentially the same thing, I am saving around £6 – if I decide to buy this lovely Toyota MR2.

Start your insurance ahead of time

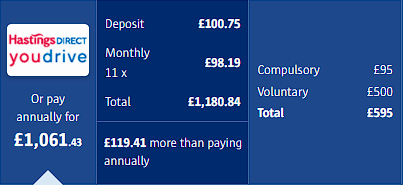

We seem to have found the sweet spot when it comes to saving on your insurance start date, we have found that 2 – 3 weeks seems to be the area you want to aim for. It does vary on the car you’re trying to insure, but this period does seem to be the cheapest on most cars from what we have tested. This method can sometimes knock hundreds off your yearly premium if you’re willing to wait little bit.

Starting this insurance quote in advance saves over £25 a month, and knocks a further £25 off the initial deposit. Good things come to those who wait.

Add an experienced named driver

This advice is given all the time and it doesn’t get much better than this, but there’s a catch, not just any named driver will do.

Ideally, your named driver should be older with a clean driving record. Good candidates for named drivers include parents and older siblings, family friends, or in some cases, grandparents. However, insurance is all over the place at the moment, and with everyone’s insurance on the rise I have actually seen named drivers negatively impacting young drivers’ insurance quotes.

But, when it all goes well, adding a named driver can save you hundreds of pounds a year. Sometimes hundreds of pounds a month, as fewer and fewer insurers will actually consider a young driver without a named driver on the policy.

Increase your voluntary excess

Pay for insurance annually

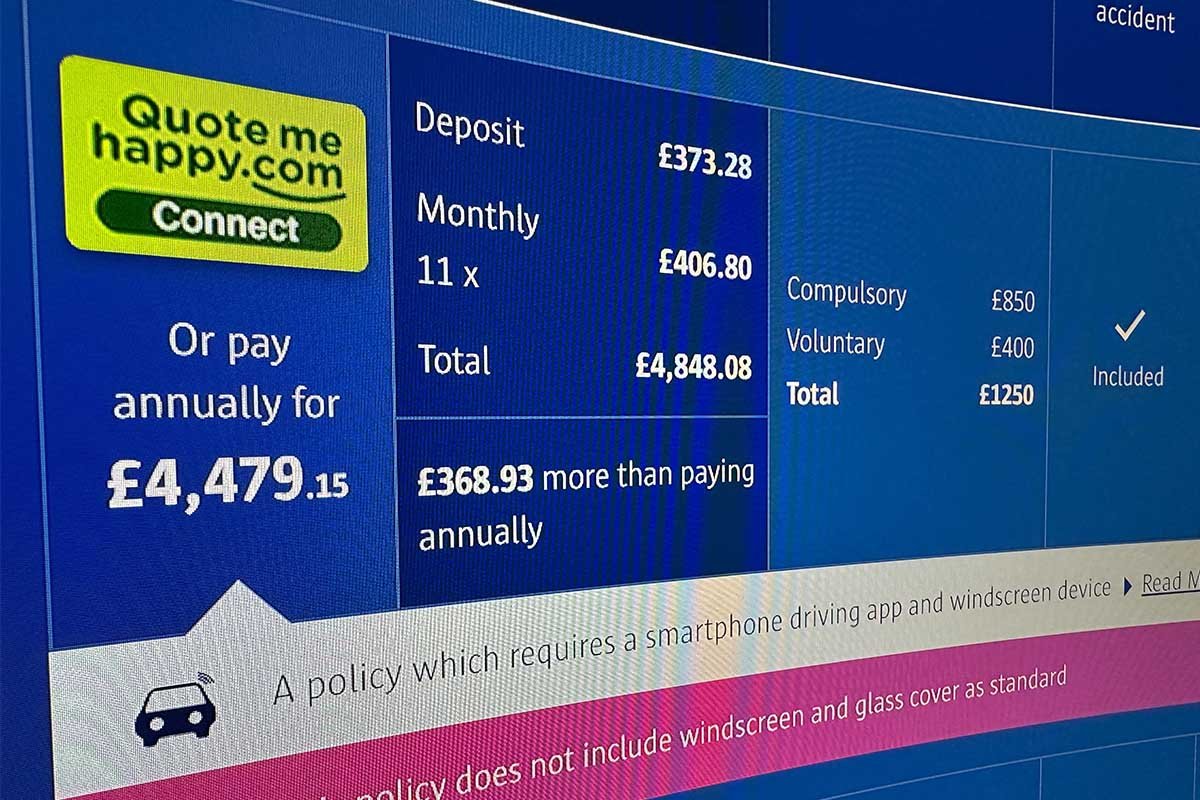

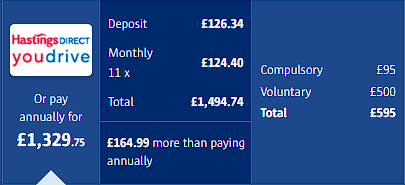

I know, if you’re a new driver, you’re likely young and probably don’t have a couple of grand laying around – but if you do, hey, good for you. If you wanted to, you could pay off your car insurance all in one go, and save hundreds a year over paying monthly. Insurers do this as a kind of interest, as car insurance counts as a credit on your credit file, you kind of borrow the money “set it aside” in case you have an accident.

Install security features

We have some tips on the best dashcam if you’re looking for one.

Consider black box car insurance

I know, I know, nobody wants to be bound by the terrible restrictions that come with a black box. The curfews, the constant monitoring, you got a car to get more freedom, not less. However, the savings cannot be denied.

A lot of “black box” insurance can now be done with a smartphone app, it’s not always necessary to fit a box to your car. A word of warning though, if you drive like an idiot, your insurance premiums will soar the next time you come to get insurance, so be warned. I never went for black box insurance, but that doesn’t mean it’s nit a good option for sensible drivers.

FAQs

There are a plethora of reasons insurance premiums keep rising. There’s still a cost of living crisis for many, cars are getting more expensive to repair and there’s a shortage of people to repair them. Not only that, but insurance providers are first and foremost a business, every business took the cost of living crisis as an opportunity to “justifiably” drive up prices.

Never lie to car insurers, there’s a very high chance that, if caught, your car insurance will be voided. Or, if it’s a minor lie, you will likely have to pay an admin fee to set the lie straight. Whilst we have never heard fo anyone going top prison for lying to their insurers, we have certainly heard fo people getting into trouble fo driving with voided insurance.

Though it seems like it will never end, your car insurance will gradually get less expensive the more no-claims bonus (NCB) you receive. Although, the address has the biggest effect on how much your car insurance is. So if you want to make a drastic difference to your car insurance quickly, you might have to move or get a cheaper car to insure.

As electric cars become more common, the insurance has come down slightly. However, electric cars remain more expensive to repair and require specially trained mechanics. So that will factor in if you are a new driver with noi real driving experience.